The COVID-19 outbreak is quickly shaking up the status quo in many sectors and that includes the consumer packaged goods (CPG) industry, which has been slow to embrace CPG eCommerce and diversifying supply chains.

With a near-universal spike in demand for essential goods and medical supplies, the CPG industry was caught off guard by rapid turnover and frequent out-of-stocks. Many grocers reported that infant formula, staples, and water continued facing below-average stock levels. It’s a complicated issue, and limited technology adoption such as eCommerce among CPGs doesn’t help things. For most brands, the production to delivery lifecycle is 12 to 16 weeks. The pandemic has proven that the cycle must be shortened and the real challenge is getting the right quantity of product to the right store in the right region at the right time.

CPG brands are discovering that it’s imperative to invest in technologies, particularly CPG eCommerce, to collaborate digitally with distributors, wholesalers, and retailers and improve supply chain management. They must also craft a unified omnichannel approach to sell through both traditional and digital channels.

Challenges for CPGs In the Face of Growing Demand

The challenges of increased demand and supply chain disruptions require a focused and coordinated response by businesses. Priorities include the restoration of B2B supply chain continuity, distribution, logistics, and remaining attuned to consumer demands. However, these are not the only challenges brands face in today’s quickly shifting CPG landscape.

Adjusting to demand

The COVID-19 pandemic is disrupting every sector and CPG is no exception. More than ever, today’s businesses must keep up with changing regulations, industry news, competitor behavior, customer demand and act accordingly. For example, this could mean shifting the focus to shelf-stable pantry essentials over luxury confections, while accepting that demand for all food products will continue to fluctuate.

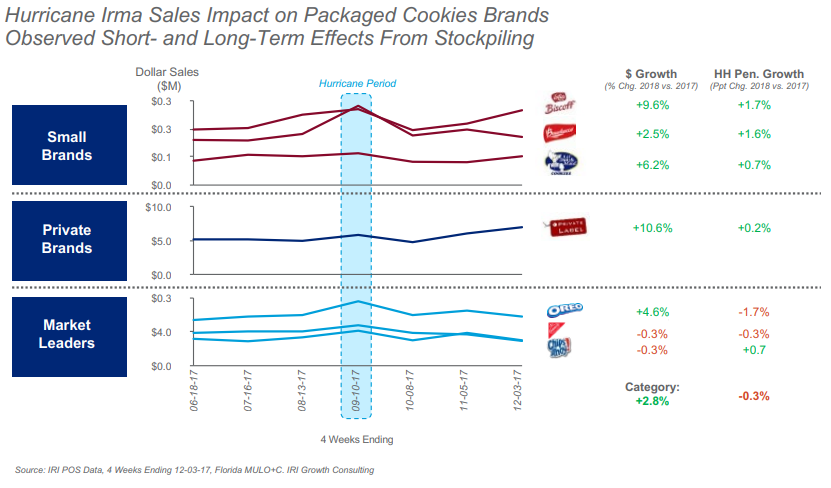

Price sensitivity

With customers economizing their food budgets, private label products can see an increase in popularity. Following a crisis, even as stockpiling subsides, customers may abandon their go-to brands in favor for lower-priced alternatives. Purchasing patterns pre and post Hurricane Irma demonstrate that lower-cost products or those with lower penetration levels saw near-universal repeat purchases and long-term growth.

[Source]

Supply chain challenges

In our ongoing post about the global supply chain crisis, we explored the impact of government regulations on supply chains. For example, fulfillment centers in the EU have seen impacts due to worker shortages caused by border closures. Carriers relying on drop off and pick up points in businesses affected by lockdown suffered as well. Since all regions are likely to face similar challenges with regard to regulation and customer demand, CPG businesses should build in flexibility such as multi-carrier approaches and redundancy in cross-docks.

Logistics challenges

One way to minimize disruptions is by regularly reviewing and planning ahead for delivery gaps, especially if dealing with known affected suppliers, logistics companies, or regions. Implementing quick ways to shift carriers and performing stress tests and test runs will help CPGs maintain continuity. As supply chain challenges unfold, it’s important to monitor logistics infrastructure (resources such as EU disruption updates and truck crossing time monitors can help) and changing operations. For example, some LTL carriers are suspending reimbursement for failed on-time delivery of time-sensitive shipments and others are now providing touch-proof delivery receipts.

Manufacturing challenges

As industries and companies experience different shapes of recovery, some manufacturers will be able to return to a pre-pandemic model while others will need to seek out new markets or adapt for a resurgence in older markets. Further into the future, as the post-crisis world emerges, CPG manufacturers should be ready to reframe their products and enter new markets. They must act on opportunities by adjusting positioning or building in the ability to quickly pivot to preserve operations in the worst-case scenario.

Increased competition

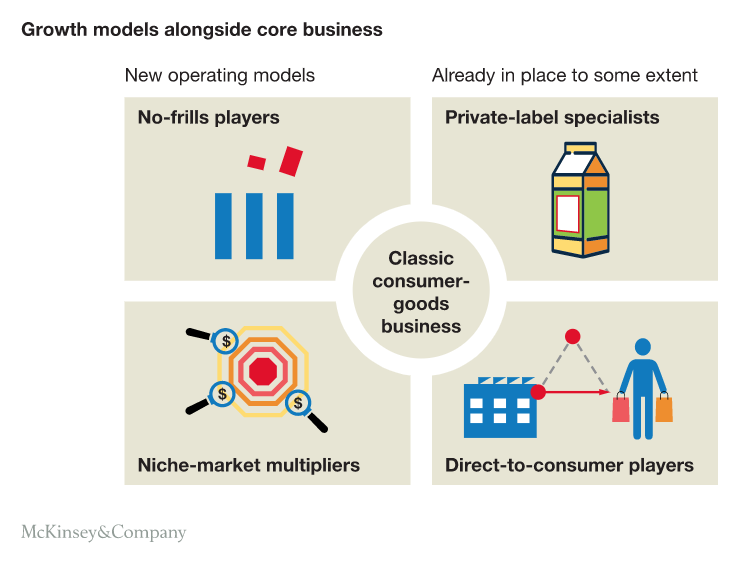

Giants like Walmart and Amazon were able to quickly move into B2B, B2C and D2C markets as their infrastructure gave them the ability to provide the convenience and product availability shoppers demand. But smaller competitors in the CPG sphere have been focusing on more than just scale since 2015. By creating differentiated offerings for targeted segments, they tap into unmet consumer wants. These offerings range from health-focused items like plant-based, and organic foods to product variations such as yogurt packaged for breakfast, snacks, or indulgent treats. By using data to develop and market products that address specific preferences, they are positioned to take advantage of every opportunity that arises.

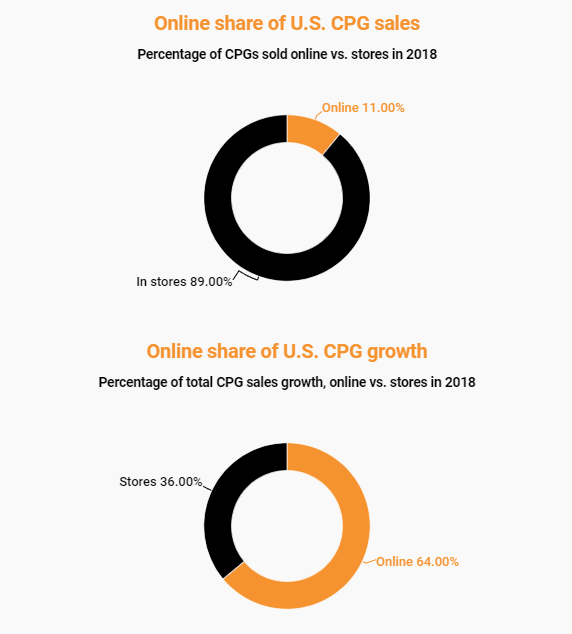

Growth of online sales

The increased demand for online grocery shopping – a relatively unfamiliar channel in many US CPG markets – has placed strain on companies. Even well-positioned fulfillment players such as Instacart face limited delivery availability, while Amazon’s 1- and 2- hour delivery promises have been tested across the country. Pressures from new and old competitors and increasing online-only consumption patterns are forcing CPG brands to adapt or risk losing out in their markets.

Subscription services

While many of us are no strangers to subscription services, the CPG industry and direct-to-consumer brands are ripe for disruption. In fact, more than half (54%) of online shoppers choose subscription services based on their convenience. CPGs with an online presence and fulfillment capabilities are well-positioned to take advantage of this growing trend.

Omnichannel shopping

Customers are limiting their in-person communications and exploring new ways to interact with their favorite brands. In delivering on-location, on-time availability, brands must embrace the full potential of digital and everything it entails. This includes omnichannel retailing, marketing, shopping experiences, direct sales, and delivery options such as BOPUS (buy online, pick up in-store) and curbside pickup.

Back-office analytics

The crisis demonstrated that all of us – brands included – are open to digital, virtual meetings and tech-enabled activities. From inventory and order fulfillment to new ways of working remotely, there are many digital tools to help businesses stay ahead of the competition. Technologies in sales and eCommerce automation, CPG eCommerce tools and ERP systems can offer real-time visibility into product categories, supply chains, and other back-office activities.

How CPG eCommerce Addresses CPG Challenges

Purchase patterns of CPG products are seeing numerous shifts. The demand for convenience in everything from consumer products to building materials eCommerce changed how people shop for these products. That has given birth to brands such as Dollar Shave Club and Sun Basket meals. As restaurants, bars, and clubs remain closed, limiting alcohol sales, eCommerce can absorb some of that demand.

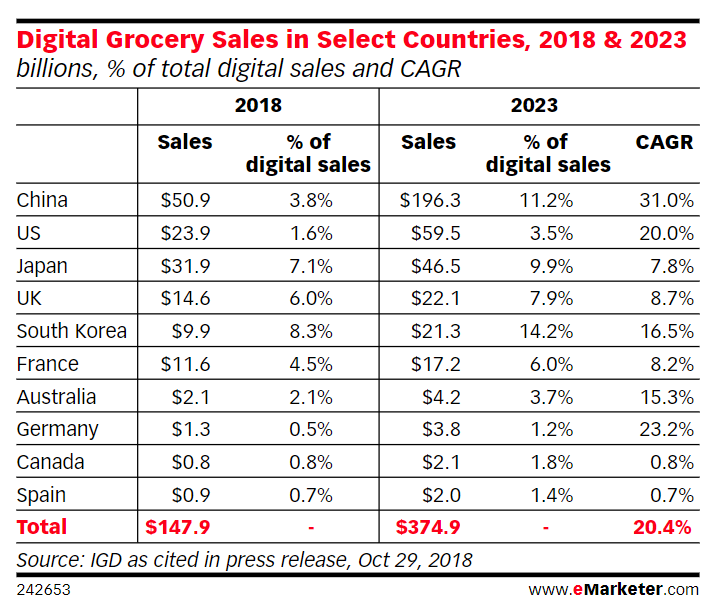

But we shouldn’t put all the blame on the COVID-19 crisis, either. Long before that, eCommerce has been gaining worldwide adoption in the CPG industry. While APAC countries have long been used to purchasing groceries online, the US-based packaged goods industry was slow to adopt this buying pattern. Now, CPG retailers, manufacturers, and distributors realize that without quickly moving online, others will take their place.

[Source]

According to eMarketer, US grocery sales is the fastest-growing online product category, predicted to jump from $23.9 billion to $59.9 billion in 2023. Sales in China and Japan reached $50.9 billion and $31.9 billion, respectively. Not only is China the biggest digital grocery player in the world, but its revenues are also set to quadruple by 2023.

Growth of online grocery shopping in the US is driven by buying habits of millennials and the rapid expansion of large CPG players into the online space. Amazon holds the largest market share, but brick and mortars like Walmart, Target, and Kroger are also heavily investing and are a driving force behind this trend.

In order to keep up during changing times, CPG brands of all sizes have no choice but embrace digital marketing initiatives, and increase their commitments to digital commerce.

Why CPGs Require Omnichannel eCommerce

New Markets

As the food landscape and purchase patterns change, CPG trends in eCommerce evolve, as well. Many companies have already shifted many of their marketing activities from offline to online. As time goes on, customers will want to purchase on the channels they are accustomed to using. Businesses will have no choice but to rely on digital tools such as B2B eCommerce platforms to better adapt to changing consumer behavior.

- An eCommerce platform is a 24/7 salesperson, billboard, and support representative. It gives CPG businesses easy access to local and global markets without dealing with costly overhead or opening additional offices.

- Taking a bigger piece of the pie becomes easier. Merchants that implement CPG digital transformation, you can offer products via personalized, country-specific portals, in the customer’s currency, payment options and shipping preferences.

- You can shift your business model as markets evolve. Flexibility and customization potential around product, pricing, and user experience makes selling over multiple eCommerce channels such as B2B, B2C, B2B2C and D2C possible.

- Online shopping is attractive to those restricted to their homes or the disabled since they likely avoid shopping in person. This shift in buying patterns presents a new market for CPG sellers as these customers will continue on-line shopping even after the outbreak subsides.

[Source]

Marketing

There are hundreds of retailers offering thousands of consumer goods. Why should someone choose to give you their money? Research by CSP demonstrates that while price is important, customers choose to pay more if the brand improves the environment, offers health-conscious choices, or a tech-friendly shopping experience. A CPG eCommerce strategy allow businesses to…

- Manage an industry blog, product comparisons, and other content marketing initiatives. Share the founding story, what the brand stands for, and how it helps its target market. Don’t forget to keep your audience informed with updates and become a place to turn for authoritative information.

- Create display advertising, rotating banners or widgets that promote specific, high-margin products. Bring attention to in-demand products through suggested or bundled recommendations. Use product pages for display advertising and for spreading awareness via social media channels.

- Increase search engine rankings. Adoption of online channels by CPG businesses remains low, but is quickly accelerating. By investing in B2B eCommerce, brands can make use of a first-mover advantage in SEO. This cements brand recognition and builds customer loyalty.

Customer Experience

As customers move online, they require a new level of closeness, more frequent communication, and also more immersive self-service experiences. This includes an easy way to check, track, modify orders, and receive support. Be ready to react to eCommerce trends in CPG by beefind up the customer experience in the following ways:

- Prioritize great online experiences. Shoppers that move online during the crisis are likely to remain there long-term. Intuitive shopping portals with the right functions minimize the need for customers to contact the support representative.

- Gain more control over pricing and promotions. During peak demand, an eCommerce B2B system enables CPGs to supply customers with the most accurate inventory and shipping information, increasing the odds of purchase.

- Maximize your marketing spend. By embracing digital over OOH (out-of-home) advertising, brands quickly and easily adjust their marketing strategies. Use split testing and A/B testing to identify your best performing buys.

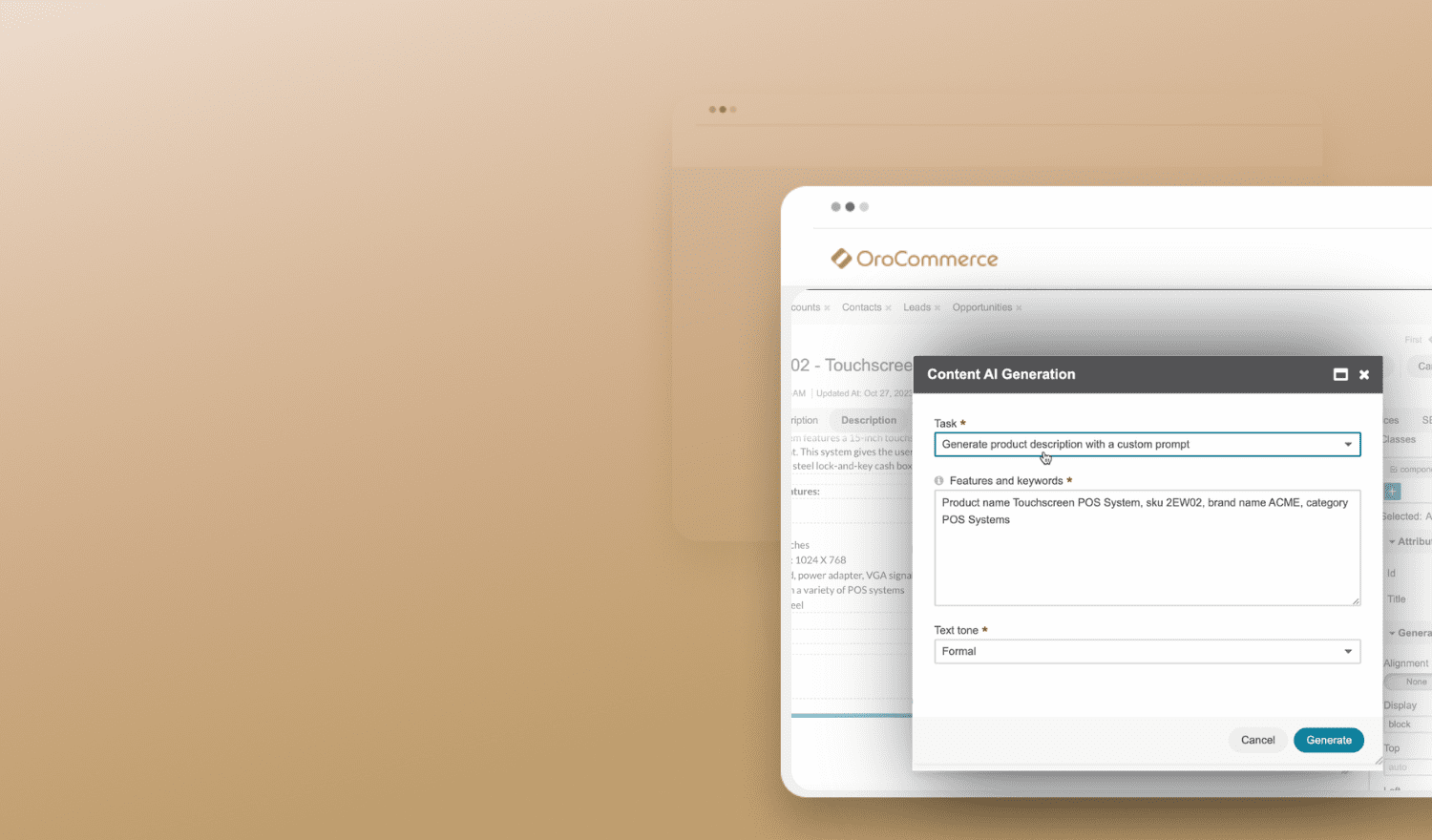

Operational Efficiency

CRM, PIM eCommerce, and ERP systems, when combined with digital commerce solutions, increase operational efficiency, decrease order errors, and simplify common back-office functions. Sales staff spend less time on error-prone manual data entry, and more time helping customers. A CPG eCommerce strategy can offer the following advantages:

- Gain additional insights into business processes through analytics. This helps simplify product catalogs, diversify distribution channels and diversify manufacturing to minimize production stoppage.

- Utilize the right data to beef up supply chains. Begin with contingency planning that secures continuity of supply. Then, determine your chain’s weakest links, such as workforce, raw materials, or warehouse space.

- Promote agility by embracing multifunctional teams and third-party resellers. As many brick-and-mortars struggles, leveraging a B2B eCommerce platform to assist manufacturers and distributors can not only open new business opportunities, but also strengthen existing relationships.

Why CPG eCommerce Is a Must in Today’s CPG Market

The relative stability of online commerce in the face of uncertainty with COVID-19 means that many consumer packaged good businesses have no choice: they must sell digitally. By focusing on branding, new markets, the customer experience – all while keeping a close eye on operations with the help of a CPG eCommerce platform – CPG businesses can remain successful during a turbulent time.

As the crisis continues to shape and reshape consumer purchasing preferences your CPG strategies should not remain idle. Use today’s trends and forces as an opportunity to revisit your eCommerce standing, to bolster your current market and expand into new ones.

Interested in learning more? Explore the key players in today’s diverse B2B eCommerce software market and find out why IDC chose OroCommrece over giants like Oracle and Salesforce: